Is There A Sales Tax On Shoes In Massachusetts . Web the base state sales tax rate in massachusetts is 6.25%. Massachusetts clothing tax is calculated based on the cost of the product: But that’s where things can get a little tricky for online sellers. Web sales and use tax for individuals. Learn what is and isn't subject to sales and use tax in massachusetts. Web in the state of massachusetts, the clothing exemption is limited to clothing and footwear which costs of a maximum of 175 dollars. Items above $175 are taxable at the statewide massachusetts rate of 6.25%. Local tax rates in massachusetts range from 6.25%, making. Web in massachusetts, all clothing and footwear items at $175 or less are exempt from sales tax. Most items that cost less than $175 are exempt from sales tax, including everyday shoes and even. Web how to navigate massachusetts clothing tax.

from masslandlords.net

Web in the state of massachusetts, the clothing exemption is limited to clothing and footwear which costs of a maximum of 175 dollars. Web sales and use tax for individuals. Web the base state sales tax rate in massachusetts is 6.25%. But that’s where things can get a little tricky for online sellers. Learn what is and isn't subject to sales and use tax in massachusetts. Massachusetts clothing tax is calculated based on the cost of the product: Local tax rates in massachusetts range from 6.25%, making. Most items that cost less than $175 are exempt from sales tax, including everyday shoes and even. Web in massachusetts, all clothing and footwear items at $175 or less are exempt from sales tax. Items above $175 are taxable at the statewide massachusetts rate of 6.25%.

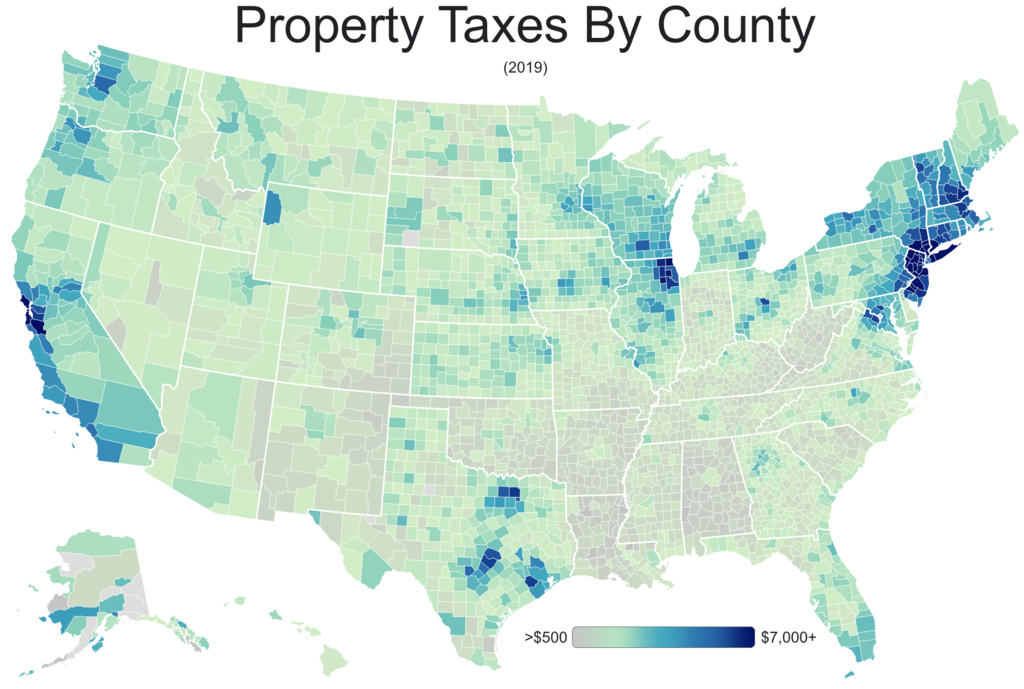

How Much Are Your Massachusetts Property Taxes?

Is There A Sales Tax On Shoes In Massachusetts Web the base state sales tax rate in massachusetts is 6.25%. Web the base state sales tax rate in massachusetts is 6.25%. Web in the state of massachusetts, the clothing exemption is limited to clothing and footwear which costs of a maximum of 175 dollars. Massachusetts clothing tax is calculated based on the cost of the product: But that’s where things can get a little tricky for online sellers. Web in massachusetts, all clothing and footwear items at $175 or less are exempt from sales tax. Web how to navigate massachusetts clothing tax. Local tax rates in massachusetts range from 6.25%, making. Items above $175 are taxable at the statewide massachusetts rate of 6.25%. Most items that cost less than $175 are exempt from sales tax, including everyday shoes and even. Learn what is and isn't subject to sales and use tax in massachusetts. Web sales and use tax for individuals.

From nelieymelanie.pages.dev

Texas Sales Tax Calendar 2024 Lenee Nichole Is There A Sales Tax On Shoes In Massachusetts But that’s where things can get a little tricky for online sellers. Learn what is and isn't subject to sales and use tax in massachusetts. Most items that cost less than $175 are exempt from sales tax, including everyday shoes and even. Web in the state of massachusetts, the clothing exemption is limited to clothing and footwear which costs of. Is There A Sales Tax On Shoes In Massachusetts.

From masslandlords.net

How Much Are Your Massachusetts Property Taxes? Is There A Sales Tax On Shoes In Massachusetts Web in the state of massachusetts, the clothing exemption is limited to clothing and footwear which costs of a maximum of 175 dollars. Most items that cost less than $175 are exempt from sales tax, including everyday shoes and even. Items above $175 are taxable at the statewide massachusetts rate of 6.25%. Web how to navigate massachusetts clothing tax. But. Is There A Sales Tax On Shoes In Massachusetts.

From games.assurances.gov.gh

Download Form St5 Is There A Sales Tax On Shoes In Massachusetts Web how to navigate massachusetts clothing tax. Most items that cost less than $175 are exempt from sales tax, including everyday shoes and even. But that’s where things can get a little tricky for online sellers. Web sales and use tax for individuals. Local tax rates in massachusetts range from 6.25%, making. Items above $175 are taxable at the statewide. Is There A Sales Tax On Shoes In Massachusetts.

From templates.esad.edu.br

Printable Sales Tax Chart Is There A Sales Tax On Shoes In Massachusetts Local tax rates in massachusetts range from 6.25%, making. Web in the state of massachusetts, the clothing exemption is limited to clothing and footwear which costs of a maximum of 175 dollars. But that’s where things can get a little tricky for online sellers. Learn what is and isn't subject to sales and use tax in massachusetts. Most items that. Is There A Sales Tax On Shoes In Massachusetts.

From webinarcare.com

How to Get Massachusetts Sales Tax Permit A Comprehensive Guide Is There A Sales Tax On Shoes In Massachusetts Local tax rates in massachusetts range from 6.25%, making. Web how to navigate massachusetts clothing tax. Web sales and use tax for individuals. Web in massachusetts, all clothing and footwear items at $175 or less are exempt from sales tax. But that’s where things can get a little tricky for online sellers. Massachusetts clothing tax is calculated based on the. Is There A Sales Tax On Shoes In Massachusetts.

From quaderno.io

Is There Sales Tax in Every State? Is There A Sales Tax On Shoes In Massachusetts Massachusetts clothing tax is calculated based on the cost of the product: Web in the state of massachusetts, the clothing exemption is limited to clothing and footwear which costs of a maximum of 175 dollars. Web sales and use tax for individuals. Web the base state sales tax rate in massachusetts is 6.25%. Web in massachusetts, all clothing and footwear. Is There A Sales Tax On Shoes In Massachusetts.

From blog.accountingprose.com

Massachusetts 2023 Sales Tax Guide Is There A Sales Tax On Shoes In Massachusetts Web in the state of massachusetts, the clothing exemption is limited to clothing and footwear which costs of a maximum of 175 dollars. Massachusetts clothing tax is calculated based on the cost of the product: Learn what is and isn't subject to sales and use tax in massachusetts. Local tax rates in massachusetts range from 6.25%, making. Items above $175. Is There A Sales Tax On Shoes In Massachusetts.

From rock929rocks.com

Massachusetts Sales Tax Weekend Is It Still Cool? Is There A Sales Tax On Shoes In Massachusetts Web the base state sales tax rate in massachusetts is 6.25%. Learn what is and isn't subject to sales and use tax in massachusetts. Web in the state of massachusetts, the clothing exemption is limited to clothing and footwear which costs of a maximum of 175 dollars. Most items that cost less than $175 are exempt from sales tax, including. Is There A Sales Tax On Shoes In Massachusetts.

From joyceqserena.pages.dev

No Tax Day Massachusetts 2024 Dodi Kriste Is There A Sales Tax On Shoes In Massachusetts Most items that cost less than $175 are exempt from sales tax, including everyday shoes and even. Learn what is and isn't subject to sales and use tax in massachusetts. Items above $175 are taxable at the statewide massachusetts rate of 6.25%. But that’s where things can get a little tricky for online sellers. Massachusetts clothing tax is calculated based. Is There A Sales Tax On Shoes In Massachusetts.

From jenniyvaleda.pages.dev

When Is Tax Day 2024 In Massachusetts Judy Sabine Is There A Sales Tax On Shoes In Massachusetts Items above $175 are taxable at the statewide massachusetts rate of 6.25%. But that’s where things can get a little tricky for online sellers. Massachusetts clothing tax is calculated based on the cost of the product: Learn what is and isn't subject to sales and use tax in massachusetts. Web sales and use tax for individuals. Web in massachusetts, all. Is There A Sales Tax On Shoes In Massachusetts.

From us.meruaccounting.com

Understanding US Sales Tax A Guide for Businesses Is There A Sales Tax On Shoes In Massachusetts Massachusetts clothing tax is calculated based on the cost of the product: Learn what is and isn't subject to sales and use tax in massachusetts. Web the base state sales tax rate in massachusetts is 6.25%. But that’s where things can get a little tricky for online sellers. Items above $175 are taxable at the statewide massachusetts rate of 6.25%.. Is There A Sales Tax On Shoes In Massachusetts.

From www.formsbank.com

Form St5 Sales Tax Exempt Purchaser Certificate Massachusetts Is There A Sales Tax On Shoes In Massachusetts Most items that cost less than $175 are exempt from sales tax, including everyday shoes and even. Web sales and use tax for individuals. Items above $175 are taxable at the statewide massachusetts rate of 6.25%. Web in the state of massachusetts, the clothing exemption is limited to clothing and footwear which costs of a maximum of 175 dollars. Web. Is There A Sales Tax On Shoes In Massachusetts.

From www.ntu.org

Tariffs Aren't Working to Change China. Here's a Better Idea Is There A Sales Tax On Shoes In Massachusetts Web how to navigate massachusetts clothing tax. Items above $175 are taxable at the statewide massachusetts rate of 6.25%. Most items that cost less than $175 are exempt from sales tax, including everyday shoes and even. Massachusetts clothing tax is calculated based on the cost of the product: Web in massachusetts, all clothing and footwear items at $175 or less. Is There A Sales Tax On Shoes In Massachusetts.

From printableformsfree.com

Massachusetts Form 1 Fillable Pdf Printable Forms Free Online Is There A Sales Tax On Shoes In Massachusetts Local tax rates in massachusetts range from 6.25%, making. Most items that cost less than $175 are exempt from sales tax, including everyday shoes and even. Learn what is and isn't subject to sales and use tax in massachusetts. Massachusetts clothing tax is calculated based on the cost of the product: But that’s where things can get a little tricky. Is There A Sales Tax On Shoes In Massachusetts.

From fayeblonnie.pages.dev

Sales Tax Calculator 2024 Washington Loise Rachael Is There A Sales Tax On Shoes In Massachusetts Web sales and use tax for individuals. Local tax rates in massachusetts range from 6.25%, making. Massachusetts clothing tax is calculated based on the cost of the product: Items above $175 are taxable at the statewide massachusetts rate of 6.25%. Learn what is and isn't subject to sales and use tax in massachusetts. Web in massachusetts, all clothing and footwear. Is There A Sales Tax On Shoes In Massachusetts.

From www.zrivo.com

Massachusetts Sales Tax 2023 2024 Is There A Sales Tax On Shoes In Massachusetts Local tax rates in massachusetts range from 6.25%, making. Web in the state of massachusetts, the clothing exemption is limited to clothing and footwear which costs of a maximum of 175 dollars. Web sales and use tax for individuals. Items above $175 are taxable at the statewide massachusetts rate of 6.25%. Learn what is and isn't subject to sales and. Is There A Sales Tax On Shoes In Massachusetts.

From live959.com

Proposed Massachusetts Sales Tax Cut Is There A Sales Tax On Shoes In Massachusetts Web sales and use tax for individuals. Learn what is and isn't subject to sales and use tax in massachusetts. Web in the state of massachusetts, the clothing exemption is limited to clothing and footwear which costs of a maximum of 175 dollars. Web how to navigate massachusetts clothing tax. Items above $175 are taxable at the statewide massachusetts rate. Is There A Sales Tax On Shoes In Massachusetts.

From www.templateroller.com

Form ST4 Fill Out, Sign Online and Download Printable PDF Is There A Sales Tax On Shoes In Massachusetts Most items that cost less than $175 are exempt from sales tax, including everyday shoes and even. Web sales and use tax for individuals. Local tax rates in massachusetts range from 6.25%, making. But that’s where things can get a little tricky for online sellers. Web the base state sales tax rate in massachusetts is 6.25%. Web how to navigate. Is There A Sales Tax On Shoes In Massachusetts.